The relentless hum of ASIC miners, the blinking LEDs of GPU rigs – these are the anthems of the digital gold rush, the soundtrack to the creation of cryptocurrency. But navigating the ever-evolving landscape of Bitcoin and altcoin mining hardware can feel like traversing a minefield. What constitutes investment-ready equipment? How do you sift through the hype and identify genuine opportunities for profitability in this volatile arena? This isn’t just about buying a machine; it’s about strategically deploying capital to capture a share of the decentralized financial future.

Bitcoin, the progenitor of it all, remains the dominant force, and its mining ecosystem is a testament to technological evolution. Early CPUs gave way to GPUs, which were then superseded by specialized ASICs (Application-Specific Integrated Circuits). Today, Bitcoin mining is largely the domain of industrial-scale operations, housed in massive data centers optimizing for energy efficiency and cooling. The Antminer series, from Bitmain, remains a heavyweight contender, consistently pushing the boundaries of hash rate and power consumption. However, the initial investment for these behemoths is substantial, and the ongoing operational costs, primarily electricity, are a crucial factor in determining profitability.

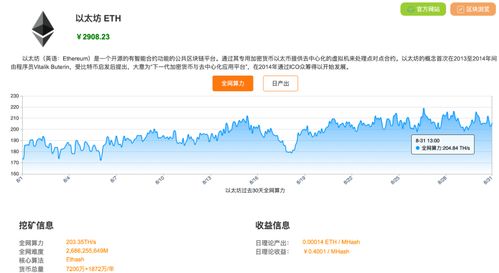

The allure of altcoins lies in their potential for exponential growth, albeit with heightened risk. Ethereum, while transitioning to Proof-of-Stake (PoS) with “The Merge,” previously fueled a vibrant GPU mining scene. Even with the transition, opportunities still exist for mining other cryptocurrencies that utilize similar algorithms. Other altcoins like Ravencoin and Ergo have emerged as GPU mining favorites, offering potentially higher returns, at least in the short term, compared to Bitcoin mining. The advantage of GPU mining lies in its versatility. GPUs can be repurposed for other computationally intensive tasks, providing a degree of resilience in a fluctuating market. Rig building, optimization, and careful selection of coins are key to success in this arena.

Beyond the hardware itself, the infrastructure supporting it is equally critical. Mining machine hosting services offer a compelling alternative to setting up a home-based operation. These services provide the space, power, cooling, and technical expertise required to run mining equipment efficiently. Location is paramount; regions with low electricity costs and favorable regulatory environments are highly sought after. However, it’s essential to conduct thorough due diligence, scrutinizing the provider’s reputation, security measures, and service level agreements. Hidden fees and unreliable uptime can quickly erode profitability.

The profitability equation is a complex interplay of factors: the hash rate of the equipment, the difficulty of the mining algorithm, the current price of the cryptocurrency, and the cost of electricity. Online mining calculators can provide estimates, but these are only snapshots in time. The market is dynamic, and profitability can fluctuate dramatically. Prudent investors conduct thorough research, develop realistic projections, and factor in a margin of safety to account for unforeseen circumstances.

The world of crypto exchanges provides the liquidity needed to convert mined coins into fiat currency or other cryptocurrencies. Selecting a reputable exchange with robust security measures and competitive fees is crucial. Furthermore, understanding trading strategies and risk management techniques is essential for maximizing returns and mitigating potential losses. Hodling, or long-term holding, is a common strategy, betting on the future appreciation of the mined coins. However, active trading can also be employed to capitalize on short-term market fluctuations.

Ultimately, investing in Bitcoin and altcoin mining gear is a high-stakes game. It requires a blend of technical acumen, financial savvy, and a healthy dose of risk tolerance. While the potential rewards are significant, the path to profitability is fraught with challenges. Expert evaluations of investment-ready equipment are just one piece of the puzzle. Success hinges on a comprehensive understanding of the market, a well-defined strategy, and the ability to adapt to the ever-changing landscape of the cryptocurrency world.

Dogecoin, initially conceived as a meme, has cultivated a devoted community and, surprisingly, maintained a consistent presence in the crypto space. While dedicated Dogecoin ASICs exist, it’s often mined using the same hardware as Litecoin due to their shared algorithm. The profitability of Dogecoin mining is heavily influenced by its price and the overall mining difficulty, making it a more speculative endeavor than mining established cryptocurrencies like Bitcoin or Ethereum.

The environmental impact of cryptocurrency mining is a growing concern. The energy-intensive nature of Proof-of-Work (PoW) mining has drawn criticism from environmental groups and regulators. Sustainable mining practices, such as utilizing renewable energy sources and implementing efficient cooling systems, are becoming increasingly important. Furthermore, the development of more energy-efficient mining algorithms and the transition to Proof-of-Stake (PoS) are crucial steps towards a more sustainable future for the cryptocurrency industry.

A deep dive into crypto-mining hardware. Expect shrewd investment advice, unexpected profitability factors, and a glimpse into the future of digital gold rushes. A must-read for serious miners!