The world of cryptocurrency is in a perpetual state of flux, with trends shifting as rapidly as digital currencies can rise and fall. At the heart of this revolution lies the infrastructure that makes it all possible—mining machines. These specialized devices are the backbone of the cryptocurrency ecosystem, enabling the minting of coins while securing networks. From Bitcoin to Ethereum, the diversity of assets fuels a booming market for mining equipment and hosting services.

For a long time, Bitcoin dominated the conversation around cryptocurrencies, backed by an impressive network of miners powering its blockchain. Yet, as more altcoins like Dogecoin and Ethereum gained prominence, the spotlight shifted towards versatile mining rigs capable of accommodating various algorithms. The demand for machines that can seamlessly transition from one currency to another became apparent. This flexibility illustrates the importance of both hardware and adaptable mining solutions in the modern landscape.

Today’s mining farms are not just makeshift operations; they are sophisticated entities designed to optimize performance, reduce costs, and maximize uptime. The trend toward hosting mining machines has surged, offering enthusiasts and investors a viable avenue to participate without the challenges of managing equipment directly. Companies specializing in mining machine hosting are filling an essential niche, creating spaces that provide cooling systems, power supply, and network connectivity while ensuring security against the hostile elements of the market.

Bitcoin has seen its share of volatility but remains the leading cryptocurrency. Its profitability largely depends on mining technology. With energy prices and environmental concerns on the rise, miners are increasingly on the hunt for energy-efficient solutions. Innovations in mining rigs have brought about devices that consume less electricity, marking a pivotal trend in equipment sales. Companies developing or upgrading their offerings must place great emphasis on energy efficiency to attract conscientious miners.

Simultaneously, the diversification of cryptocurrencies has nurtured a wider market for mining machines. Ethereum’s shift toward proof-of-stake has challenged traditional notions around mining while spawning new opportunities for innovation. Miners are now investing in dual-purpose rigs, capable of handling different coins simultaneously, driving manufacturers to adapt rapidly or risk obsolescence. As Ethereum continues to evolve and new blockchains emerge, the ability to mine various cryptocurrencies becomes crucial.

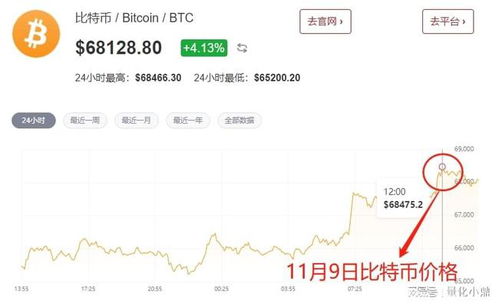

For those investing in the mining landscape, understanding exchange dynamics is vital. The profitability of mining operations hinges not only on the power of their rigs but also on the prices set on exchanges. In a market rife with speculation, miners must be adept at navigating price fluctuations. Tech-savvy miners leverage analytics and market analysis tools, determining the optimal times to mine specific cryptocurrencies, thereby enhancing their return on investment.

The rise of decentralized finance (DeFi) has further reinforced the importance of mining. Miners no longer simply acquire currency; they can contribute to liquidity pools, yield farming, and provide essential services in a decentralized marketplace. The opportunities in DeFi are a reminder that possessing a mining rig is just the beginning. A well-rounded understanding of the entire ecosystem enables miners to diversify their strategies, ensuring a more robust financial future amidst the chaotic world of cryptocurrency.

In conclusion, the landscape of cryptocurrency equipment sales is a vivid tapestry woven from technological advancements, market dynamics, and environmental considerations. As trends continue to shift, staying ahead of the curve requires a deep understanding of the forces at play. Entrepreneurs and investors must remain vigilant—whether it’s upgrading to the latest mining rig technology, choosing the right hosting options, or simply adapting to new market conditions. In this climate of change, the only constant is that innovation drives success in the mining madness of the cryptocurrency world.

“Mining Madness” offers an insightful exploration of the rapidly evolving cryptocurrency landscape, examining emerging technologies and market dynamics. The article highlights the impact of regulatory changes and sustainability initiatives on equipment sales, revealing unexpected trends that could reshape investor strategies. A must-read for enthusiasts and industry professionals alike.